- Equity Mates

- Posts

- 📈 RBA holds rates at 3.6% | China hits $1 trillion in global trade surplus

📈 RBA holds rates at 3.6% | China hits $1 trillion in global trade surplus

Here's what you need to know today

Here’s what you need to know today

Scroll down this email to find your unique referral link

Australia - 🇦🇺 🐨 🦘

RBA keeps rates on hold at 3.6%. The RBA Board’s decision to keep rates steady was unanimous. In her press conference, Governor Michelle Bullock flagged that “there are no interest rate cuts on the horizon for the foreseeable future.” (ABC)

Australia’s teen social media ban effective from today as Reddit prepares to High Court challenge. The law preventing children under the age of 16 from accessing certain social media platforms became effective at 12am this morning. Reddit, the global online forum, is preparing to challenge the ban. The case is expected to be heard through the High Court of Australia (SBS | AFR)

Airwallex raises 2nd largest venture capital funding round in Australian history. The cross-border payments platform is raising close to $500m at a valuation of $12bn. The funding round comes despite accusations last week that it stored confidential American customer details in China. (AFR)

Rio Tinto follows BHP in cutting billions from decarbonisation initiatives. Rio has announced it will spend between US$1-2bn on green projects by 2030, down from the originally forecast US$7.5bn. This comes as BHP announced it would decrease forecast spend on decarbonisation projects by $3.5bn. (AFR)

Global - 🌎 🗽 ⛩️

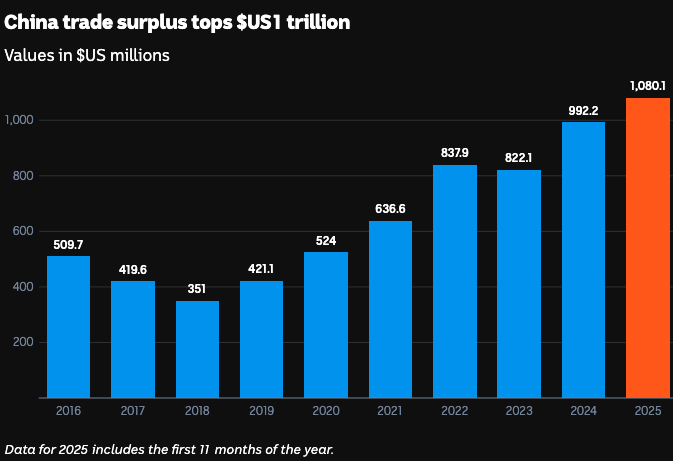

China’s global trade surplus tops US$1 trillion for first time. The milestone comes despite US trade restrictions, and shows China has been able to diversify its export markets by pursuing closer ties with European Union and South-East Asian nations. Shipments to Australia increased by 35.8% year-on-year in November. (ABC)

Source: ABC News & Trading View

Trump approves Nvidia to sell H200 chips to China. The US President announced that the AI chip manufacturer will be allowed to sell its second most advanced H200 chip to ‘approved customers’ in China. The US will subsequently collect a 25% fee on the sales. (BBC)

China adds popular Eli Lilly drug to state health insurance scheme. Mounjaro, the type 2 diabetes drug, will now be included in the Chinese national reimbursement list making it more widely available. Analysts have warned whilst this move can increase sales, it can also lower price requirements for the drug. (Reuters)

Trump unveils US$12bn package for farmers. The aid package, which will be funded by tariff revenue, will assist American farmers who have been heavily impacted by tariffs. The Trump administration has been under pressure for weeks from historically Republican states due to the impact on farmers. (FT)

Companies - 🚀 🏦 🏗️

Paramount submits US$108bn hostile bid for Warner Bros. The offer, taken directly to shareholders, proposes to pay US$30 per share for all the companies assets. It comes after the Warner Brothers board agreed to a sale to Netflix at US$72bn for its studio and streaming division. Warner Brothers acknowledged the Paramount offer saying it would “carefully review and consider” over the coming weeks. (FT)

Magnum Ice Cream Company debuts on stock exchange. The company officially listed on the Amsterdam stock exchange after it’s long awaited demerger from Unilever. The company will also take the Ben & Jerry’s brand with it, as Ben & Jerry’s co-founders continue to voice their dissatisfaction with both Unilever and Magnum’s management of their business. (CNBC | FT)

India’s largest airline shares fall more than 8% due to cancellations. IndiGo, the operator of India’s largest airline, saw shares slump due to at least 2,000 flight cancellations this past month. The cancellations arose as stricter rules on pilot rest were enforced. Reports say IndiGo failed to plan ahead for crew shortages. (CNBC)

Google VP of global ads denies Gemini ad claims. Dan Taylor, has taken to X to dispel a report that Google will introduce advertisements to it’s Gemini AI platform in 2026. “There are no ads in the Gemini app and there are no current plans to change that.” (X)

Multiple leadership changes at Berkshire. The company reported that Todd Combs the head of Geico, Berkshire’s insurance subsidiary, will be leaving to join JPMorgan Chase. He will be replaced by Geico’s COO Nancy Pierce. Berkshire CFO Marc Hamburg will retire after 40 years with the company being replaced by Charles Chang, Berkshire Energy’s CFO. (CNN)

What the…? - 🧐 👀 🙉

Musk, Bezos & Picasso are all pooping NFTs? Mike Winklemann aka ‘Beeple’ the artist responsible for the second most expensive NFT ever sold in 2021 (AFR) is back in the headlines. Beeple unveiled his latest exhibit at Art Basel 2025 in Miami, titled ‘Regular Animals’ which sees robotic dogs with the heads of Jeff Bezos, Elon Musk, Mark Zuckerberg and even Pablo Picasso walking around an enclosed area. Beeple’s commented that his choice of notable figureheads was due to “in the past, artists shaped the way we saw the world like Picasso. Increasingly, our view of the world is being shaped by tech billionaires because of their control of the algorithms that shape what we see and what we don’t see.”

And it gets even weirder. The robo-dogs whilst walking around the exhibit will take photos from their body cameras and then ‘poop’ out the images in the form of polaroid NFTs. Oh and the dogs are also priced at US$100,000 each and are completely sold out. Humans are fascinating creatures. (My Modern Met)

Investing is a lifelong journey

Here’s what you can learn today

Chris Kohler breaks down why he hates auctions

Chris Kohler recently joined us on the show to chat about his ‘How They Get You’ in his new book. Listen to the Equity Mates Investing episode titled ‘Best of the Best: Good investing starts with a great process - Andrew Mitchell | Ophir’ (Apple | Spotify | YouTube)

Ren: So Chris, how do they get us with auctions?

Chris: They're a beautiful thing because they get everyone there. They create urgency, supply and demand. There's one thing being the house and then there's a whole lot of people that want that one thing.

I think one of the really disappointing things about auctions is that the reserve is often so different from what has been advertised as the guide price, and that's a very difficult thing to change legislatively. Look, I think the hardest part is being a young person and going along when you've seen that there's a house or any kind of property with it, let's say $600,000 next to it, and then you are what I call auction fodder. You are the one who's bidding it up to that level and then all of a sudden somebody else comes in over the top and they're the ones that are going to buy it, and the agent wants you there because you're going to be doing that early bidding that they want.

So I think auctions can be very cruel. And I've been covering auctions for a long time as part of the job. I used to go around on Saturdays to three auctions a day and just go and watch with a camera. And I recognise that not everyone wanted me to be there with it being a very emotional time, with a lot of people crying afterwards.

The thing that the book was able to let me do is look into how they do it elsewhere. And it's, as you say, it's a lot more civilised in other parts of the world.

A message from First Sentier Investors

Offering access to a dynamic segment of the Australian market, companies outside of the ASX 20. The First Sentier ex-20 Australian Share Fund Active ETF provides a differentiated approach that sidesteps the dominance of heavyweight financials and resources, offering a more active and differentiated approach to Australian equity exposure.

Fund issued by Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL 235150). General advice only. Does not take account your objectives, financial situation or needs. Read PDS & TMD on FSI's website. All investments contain risk and may lose value.