- Equity Mates

- Posts

- 📈 NSW residents lose $1.1m/hour to pokies | ATO recovers $1 billion in unpaid Super

📈 NSW residents lose $1.1m/hour to pokies | ATO recovers $1 billion in unpaid Super

Here's what you need to know today

Here’s what you need to know today

ATO retrieves over $1 billion for workers. Australian employees received $1.1 billion of unpaid superannuation entitlements that the Australia Taxation Office clawed back from employers. The ATO has reminded employers to pay Super to workers, warning that there will be consequences. (Yahoo Finance)

NSW residents lose $1.1 million every hour to pokies. New data from NSW Gambling and Liquor reveals that NSW residents lost $2.45 billion from July to September, equating to over $1 million per hour. Canterbury and Bankstown were the biggest losers, combining for $202.7 million lost in the three-month period. (7 News)

Government to scrap electricity rebate. Treasurer Jim Chalmers confirmed that the $150 electricity rebate will not be renewed for 2026. The rebate rolling off is a big reason why headline inflation has increased above the RBA’s 2-3% target. (Capital Brief)

AGL ditches Gippsland offshore wind project. Energy company AGL has abandoned its plans to develop a 2.5-gigawatt wind farm off the coast of Victoria, making it the third abandoned offshore wind in the Gippsland Skies zone this year. AGL was influenced by global offshore wind challenges, including in the US. (ABC)

US PE firm buys Australian military bootmaker. Redback Boots, the Australian boot company that supplies the Australian Defence Forces, has been acquired by American private equity firm Ares Management in a deal worth almost $100 million. The investment will allow Redback to expand production to roughly 650,000 pairs of boots a year. (AFR)

UK pension funds worried about AI bubble. Pension funds managing over £200 billion in assets have begun shifting their allocations away from US markets that have become AI-heavy. Several fund managers spoke to journalists stating that high valuations and tight market concentration require diversifying away from tech stocks. (FT)

Data centres requesting up to 40 million litres of water per day. Individual data centres have lodged requests to consume up to 40 million litres of water per day according to Australia’s top water utilities. This is roughly the same daily consumption as 84,200 average Australian households. (AFR)

Regulator accuses WA power generator of overcharging. Western Australia’s Economic Regulation Authority claims Bluewaters Power, WA’s largest private electricity generator, charged $30 million more than they were legally allowed to, driving up household electricity costs. Bluewaters denies the allegations and say they had to increase the costs due to water and coal supply shortages. (ABC)

Wall Street predicts big year for US stocks. Nine major investment banks predicted a strong year for the S&P 500, with their forecasts averaging roughly 10% growth for 2026. Bank of America had the most cautious prediction with 3.5%, stating “investors are buying the dream” regarding AI. (FT)

EU fines X for digital breaches. X, formerly known as Twitter, has been fined €120 million by European Union regulators for breaching digital regulations that exposed users to scams and manipulation. One charge accuses X’s blue check marks of being deceptively designed, allowing fraudsters to impersonate celebrities and politicians by paying for the designation. (ABC)

Spotify Wrapped engages 200 million. Spotify’s annual recap function, Wrapped, engaged 200 million users, up 19% year-on-year, and was shared 500 million times in the first 24 hours, up 41% from last year. (Rolling Stone)

Paramount fights on despite Netflix-Warner Bros deal. Paramount Skydance’s is reportedly considering going to Warner Bros’ shareholders in a hostile takeover despite the Warner Bros board agreeing to a US$72 billion deal with Netflix. Warner Bros had rejected three offers from Paramount before launching a formal sale process that led to the Netflix offer. (CNBC)

What the…?

Some of Australia’s largest private hospitals are at risk of running out of money in 90 days. This warning from Catholic Health Australia comes just months after Healthscope, Australia’s second-largest private hospital operator, fell into receivership with $1.6 billion of debt.

Private healthcare operators and private health insurers are fighting over dollars, resulting in underfunded hospitals. Private hospitals argue that health insurers are giving insufficient funding to hospitals to boost their profits while insurers argue that hospitals are asking for too much and aren’t doing enough to control costs.

This financial fighting, combined with rising clinical costs, inflation, and wages, has placed the private hospital industry on a “fiscal cliff” that could result in private hospitals rapidly going out of business. (AFR)

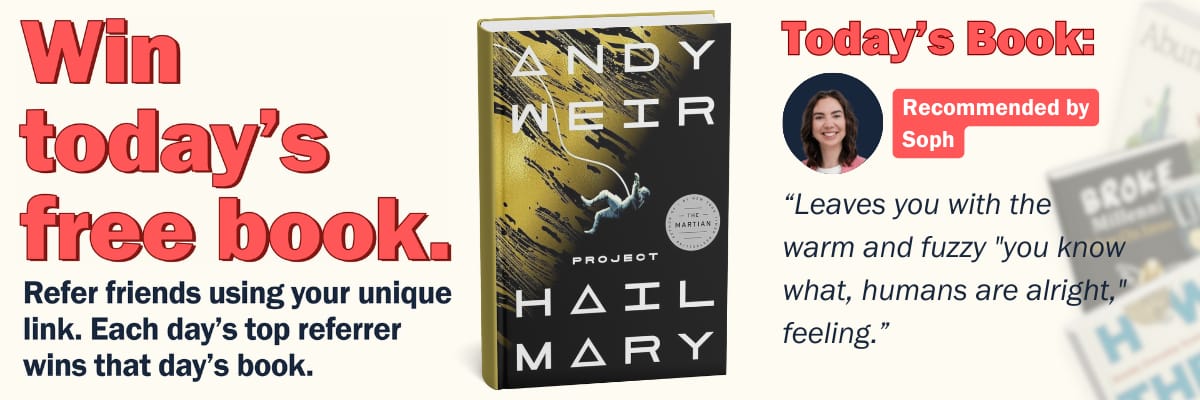

We’re giving away some of our favourite books from the 2026 Summer Reading List.

To win:

Share your unique referral link (listed below) to the world

The most referrals each day, wins that day’s book

Investing is a lifelong journey

Here’s what you can learn today

Optimising your investments for taxes

This is a segment from a conversation on Equity Mates Investing with Peter Nevill, financial adviser at Viola Private Wealth, about optimising your taxes. (Spotify | Apple | YouTube)

How do you approach tax planning and structuring at Viola Private Wealth?

Approaching the sort of tax planning piece starts really at the start with that structuring element. But then making sure that, you know, each financial year you're, you're doing the super contributions piece, you're working through, you know, realised gains and what's available in terms of unrealized losses looking to make sure we're paying as little tax as possible.

Do wealthy clients differ in their thinking about tax versus everyday Australians?

Yes and no, it's one of those where there's probably some added complexity there in terms of the structuring piece, but all the fundamentals are still very much the same. Ensuring that you've got the right assets in the right structures ensuring that you're, you know, making the sort of tax deductible contributions, making sure that you're, you know, claiming all of your deductions that are available to you in whatever form that may take.

What are the right assets in the right structures (personal, trust, company, super)?

For most people is just investing within your personal name. If you are a member of a couple, you know, investing in the spouse on the lowest marginal tax rate's name can make sense in, in reducing your tax.

Then we've got the trust, a legal relationship where you hold assets for the benefit of others. You have each beneficiary above the sort of blended 30% tax rate it can make sense to then distribute to a bucket company.

The company will pay tax at a flat 30% rate. The benefit of having a bucket company is that you can invest within that structure and retain the earnings.

The best that we have is superannuation, (which pays) a maximum of 15% in accumulation phase, (with) capital gains at 10. Once you get into pension phase, everything within the fund is tax free and everything pulled out of the fund is tax free as well.

A message from First Sentier Investors

Offering access to a dynamic segment of the Australian market, companies outside of the ASX 20. The First Sentier ex-20 Australian Share Fund Active ETF provides a differentiated approach that sidesteps the dominance of heavyweight financials and resources, offering a more active and differentiated approach to Australian equity exposure.

Fund issued by Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL 235150). General advice only. Does not take account your objectives, financial situation or needs. Read PDS & TMD on FSI's website. All investments contain risk and may lose value.