- Equity Mates

- Posts

- 📈 Jerome Powell stands his ground | Google hits $4 trillion

📈 Jerome Powell stands his ground | Google hits $4 trillion

Here's what you need to know today

Today’s Top Stories

Only got a couple of minutes? Here are the key stories you need to know.

Jerome Powell stands ground in criminal inquiry. The head of the US Federal Reserve has responded to the criminal investigation into his departments HQ renovations. “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President”. (ABC)

Trump threatens tariff on Iranian trading partners. The US President announced that countries doing business with Iran will be subject to a 25% tariff when trading with the US. This comes as Trump announced he was considering military intervention amongst anti-government protests in Iran. China, Turkey, Pakistan and India were some of Iran’s largest trading partners in 2025. (Financial Times)

Paramount sues Warner Bros. The lawsuit asks Warner Bros to explain why it prefers Netflix’s $83bn offer over Paramount’s offer of $108bn. Paramount also announced plans to nominate directors to Warner Bros’ board to vote against the Netflix deal. (Financial Times)

Alphabet hits US$4 trillion valuation. The parent company of Google becomes the 4th company in history to reach the US$4 trillion valuation mark behind Nvidia, Apple and Microsoft. The jump in valuation comes as Apple has selected Google’s Gemini to be the foundation of the AI-powered Siri. (Reuters)

What’s Making News?

A look at the stories making headlines and moving markets.

Australia

Australian economy sending mixed signals. Household spending in Australia grew 6% over the past year, suggesting that consumers are holding up okay. However consumers are worried about the future with Westpac’s consumer sentiment index falling 1.7% in January. (Reuters | Capital Brief)

Australia announces $1.2bn critical minerals strategic reserve. The federal government has announced plans to prioritise antimony, gallium and other rare earth metals required for semiconductors, fighter jets and other modern technologies. (Capital Brief)

Kevin Rudd to step down as US ambassador. The former Australian PM will end his posting a year earlier than planned. Rudd helped seal a $3 billion critical minerals and rare earth deal between Australia and the US. However, arguably the most memorable part of the deal occurred during the press conference where US President Donald Trump told Rudd “I don’t like you, and I probably never will.” (ABC)

Global

UK to bring in laws banning nonconsensual deepfakes. UK PM Keir Starmer announced to his party members that “if X cannot control Grok, we will”. This comes as countries around the world have begun to ban Grok’s AI chatbot due to its ability to create non-consensual intimate images. (BBC)

Silver hits all time highs and Gold reaches US$4,600 an ounce. The rush to these safe haven assets comes on the back of growing market uncertainty with the criminal inquiry into US Federal Reserve chairman Jerome Powell. (Reuters)

Company Watchlist

Here are the companies with big announcements or price movements

Woolworths announces agreement with Google for AI shopping. The supermarket giant will become the first in Australia to let AI agents shop for customers using Google’s Gemini AI tool. With shoppers approval, the agent will be able to automatically add items to online shopping baskets. (AFR)

Nvidia and Eli Lily announce US$1 billion AI drug discovery partnership. The AI chipmaker and weight-loss drug manufacturer have joined forced to create a lab in San Francisco to accelerate AI drug discovery. The lab is said to use large scale AI models to advance medicinal development. (Yahoo Finance)

Golden State Warriors parent company reaches US$11bn valuation. The Golden State Group which owns the NBA franchise is selling a 5% stake in the company to interested parties. The stake includes a seat on the board, court-side seats and access to the ownership lounge. (Bloomberg)

What’s got us thinking

Investing is a lifelong journey. Here’s what we’ve been learning lately.

Why we love Dollar Cost Averaging

This is an excerpt from the Equity Mates Investing episode ‘Essentials: Our investing playbook’ catch the full episode here: (Apple | Spotify | YouTube)

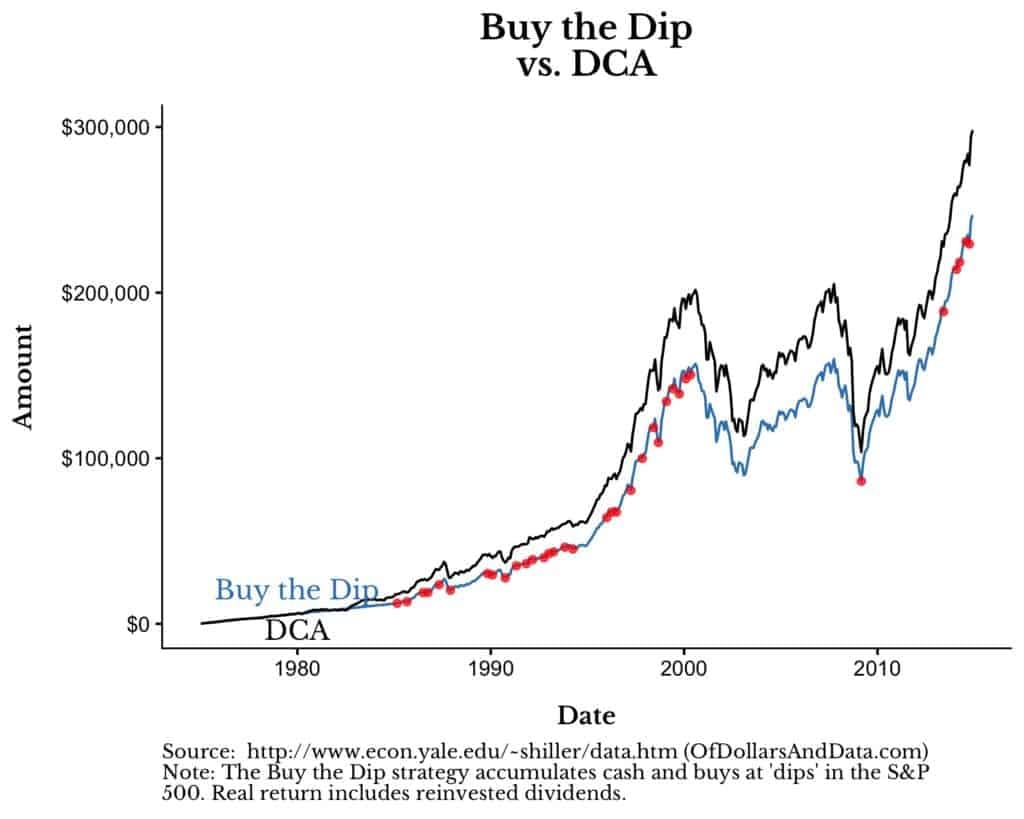

Ren: So dollar cost averaging for people unfamiliar is when you take the same amount of money and you invest at regular intervals, and it means when the market's up, that same amount of money is buying less shares because each share is more expensive. When the market's down, you're buying more shares because each share is cheaper, but over time you kind of smooth out the highs and lows of the stock market and you get the average and then it's sort of the average increase over time.

Bryce: Yeah. And so what it does, it removes the guessing game. We're not sitting here thinking, oh, markets at all time highs, we might hold off or market's crashing, it could go further, we might hold off. It just buys whatever's going on in the market, doesn't care, it's not emotional and it removes the remote emotions from the process as well.

Ren: Now here's the thing. You might be thinking, well, am I missing out? Am I leaving returns on the table by not trying to time the market? As you said, Bryce, it's very hard to time the market. No one has proven an ability to do it consistently well over time. The other thing is you often do better if you just dollar cost average and you don't have to take my word for it.

Nick Maggiulli wrote a book called Just Keep Buying and he compared buying the dip versus dollar cost averaging. He's an American author. So he looked at the US market from 1975 for 40 years. So what does that bring us to? 2015. And would you believe it? Dollar cost averaging beat buying the dip. And the reason that it beat buying the dip is the waiting. Dollar cost averaging, you're putting your money to work regularly, you're not sitting up bunch of it in cash. Whereas in the scenario he looked at, he looked at someone who waited to invest and then bought the dip. And the thing is, he had the benefit of hindsight. He was buying the dip at the right time, which is incredibly hard to do. But even just that waiting, that cash drag on your portfolio meant that buying the dip actually underperformed dollar cost averaging.

So you can read that book and you can see the example that he worked through there, but that's why we dollar cost average. That's why we don't try and time the market. It takes the stress away. It makes investing a lot easier and we're confident that over the long term, it'll get us the returns that we need.

A message from PocketSmith

With PocketSmith, you get one place to see your day-to-day spending, savings and investing side by side. Link your accounts (including multi-currency), let transactions auto-categorise, then set budgets and regular investing contributions that match how you actually live. PocketSmith’s calendar and forecasting show how each pay cycle looks in advance, while net worth tracking keeps the bigger picture in focus.

Right now, PocketSmith is offering 50% off the first 2 months of a Foundation Plan. To try PocketSmith for yourself and claim this deal, head to pocketsmith.com/equitymates

What the…?

A look at one story that has us scratching our head

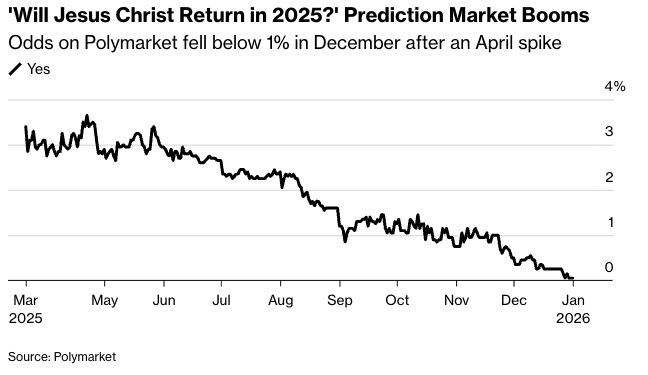

‘Will Jesus Christ Return in 2025?’ This is the question that had some gamblers on the edge of their seats during the count down to 2026. Whether Jesus Christ would return in 2025 was an actual market on the American based wagering company Polymarket that saw US$3.3million wagered in total. Polymarket wasn’t overly specific about how they would determine if Jesus Christ had actually returned stating “the resolution for this market will be a consensus of credible sources”. The ‘No’ bet was confirmed and paid out swiftly on the 1st of Jan 2026.

For those who placed their bets in April of last year, you would’ve earned an annualised profit of 5.5% before fees. Which is greater than the return of what financial markets usually consider to be a sure thing, the US Treasury bills.

But fear not, if you’re disappointed you missed out on the bet, attention has now shifted to ‘Will Jesus Christ Return in 2026?’ with Polymarket currently giving it a 2% chance. Meaning if you bet on the ‘Yes’ side you could earn over a 5,700% return. We’re still not sure we like those odds. (Bloomberg)