- Equity Mates

- Posts

- 📈 Inflation shock means no rate cut | Meet Australia's newest unicorn

📈 Inflation shock means no rate cut | Meet Australia's newest unicorn

Here's what you need to know today

Australia’s latest unicorn company has balding men ecstatic

Here’s what you need to know today

Inflation jumps 3.8% in October. Australia’s headline inflation increased more than anticipated last month, up from 3.6% in September. The largest price rises were housing (+5.9%), food and non-alcoholic beverages (+3.2%) and recreation & culture (+3.2%). This is the first month the Australia Bureau of Statistics has published monthly inflation data compared to the historical quarterly update. (Capital Brief)

All eyes on December RBA meeting. After surprising inflation figures, attention turned to the next RBA meeting in December. A few months ago, expectations were for another rate cut before the end of the year. Now, that is all but ruled out with some economists even floating the possibility of a rate increase to curb renewed inflation. (AFR)

Australian hair and weight loss company set for unicorn status. Eucalyptus, the company behind online health brands Pilot (male focused hair loss, weight loss and sexual health) and Juniper (female focused medical weight loss) is expected to reach a $1.4 billion valuation in it’s latest funding round. Eucalyptus was last valued at $560 million in January 2023. (AFR)

Construction of 82,000+ Australian homes stalled. Poor planning between federal and state governments has resulted in 12,000 construction-ready plots of land in Sydney’s south-west sitting empty since 2021. Owners have been told it may take until 2028 to connect to water and sewage infrastructure. (ABC)

Labor targeting $5.6b cut to public service. In what could be one of the biggest cost-cutting endeavours undertaken by the government, the Finance Minister Katy Gallagher has informed cabinet ministers and public service officials to find cost savings of up to 5% in their budgets. The cost of the public service has increased by 38% in the past four years reaching $111 billion this year. (AFR)

Google with $4 trillion market value in sights. Parent company of Google, Alphabet, has bucked market sentiment that it was left behind in the AI race. With the launch of it’s new Gemini AI model and reports Meta may also be in discussions to buy Alphabet designed chips instead of Nvidia chips, the parent company of Google fully embracing the AI revolution. Shares in the company are up 70% for the year. (Quartz)

US consumer confidence second lowest point since COVID. The Conference Board conducts a monthly survey of 5,000 households based on consumers outlook for income, business and labour market conditions. The index of consumer confidence dropped sharply in November. The only time when the index has been lower in the past 5 years was post ‘Liberation Day’ in April. (Financial Times)

UK to deliver highly anticipated annual budget. Rachel Reeves, the chancellor of exchequer (fancy name for treasurer) is set to deliver her second budget since assuming the role. The budget is set to focus on cost of living and increasing the minimum wage within the UK. Reeves faces a £20 billion gap in public finances which is expected to rely on tax increases that impact workers. (The Guardian)

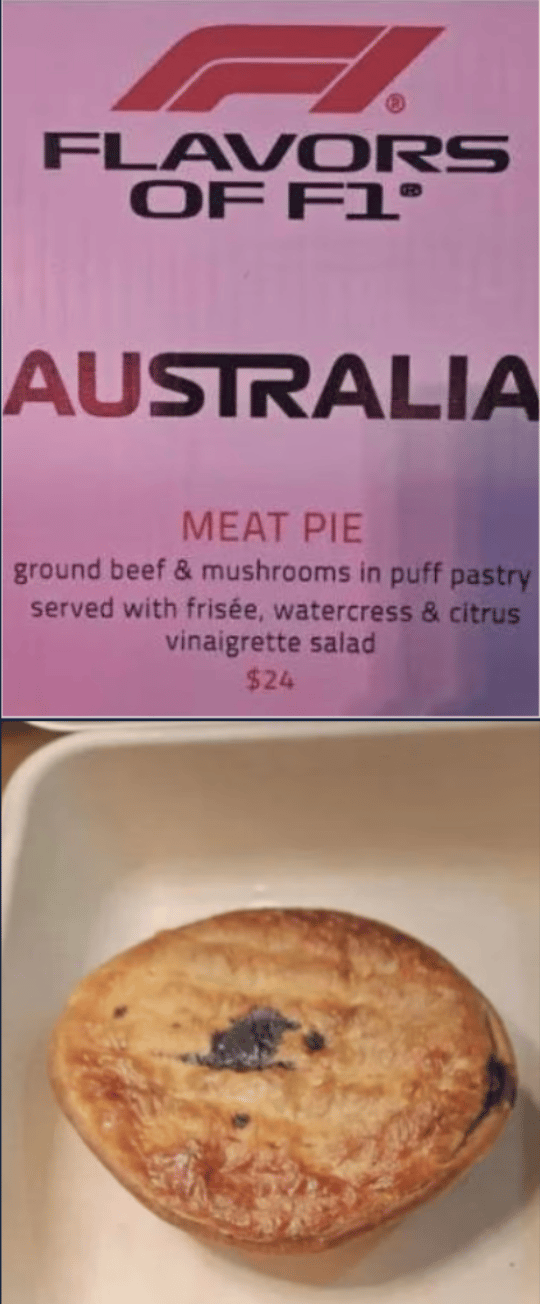

What the…?

Aussie fans at the Las Vegas Grand Prix last weekend have been left gobsmacked over the price of a meat pie. NZ IndyCar driver Scott McLaughlin shared on X the price of a meat pie was US$24 which amounts to around AUD$37!! We’re almost too afraid to ask what the price of a squeezable tomato sauce packet would be. (7 News)

This isn’t the first time the price of food at an F1 event has drawn public scrutiny. The 2024 Miami Grand Prix made headlines for an exclusive trackside club where VIP guests could pay $270 for nachos or $260 for a poke bowl. (News.com)

Investing is a lifelong journey

Here’s what you can learn today

Property or Stocks: You don’t have to choose

This is an excerpt taken from the Get Started Investing episode ‘Property or Stocks: Which should you buy first?’ check out the full episode (Apple | Spotify | YouTube)

Bryce: People are probably thinking, well why don't I just do what many Australians do and go all in on property because it seems like that's the environment is set up for that.

Ren: Yeah. So it is a good question. Let me answer this two ways. Property and shares both play different roles in a well-diversified and well-functioning portfolio. Property, as you said, you get that leverage benefit and you also get a lot of tax optimisation benefits. It's undeniable. Shares, you get liquidity and diversification. And I think people sleep on just how reliant a lot of Australians are on the Australian economy going well, Australian banks going well and the never ending government fuelled housing pump continuing for their long-term wealth. I think diversifying out of Australia and investing globally is really important. The second thing that I think people often sleep on is that you can't eat a house and you can't sell half of a house. People are asset rich and cash poor in a lot of ways. And particularly people who maybe bought a place 30 years ago for four times their income and are now sitting on an asset that might be 10 times their income. If they want to sell part of it to go on a holiday or whatever, then you're forced to sell the family home. The liquidity benefit of shares and some assets, bonds and gold and crypto I guess, although that's a different conversation, allows you flexibility in your life that having one really valuable property or a couple of really valuable properties just doesn't give you.

Bryce: Yeah, it's the classic case of not having all of your eggs in one basket.

Ren: Well that was diversification, but liquidity is also important.

Bryce: Yes. You're not going to be able to sell your house, like that snap.

Ren: It's like having eggs that you can sell in a basket rather than having a gold plated basket with no eggs.

Bryce: So look, there's plenty of ways that you can make money as an investor and we're here to say that there's not one right way. There are plenty of different ways and for us when we think about property and stocks and we just think about our own journey as well, it's a matter of sequencing. It's not a matter of picking sides and then sticking with that for the rest of our journey. So think about it from your point of view. If you're early on in your investing journey, you don't have a lot of money, property is probably a little out of reach, but don't let that stop you from getting started in shares for all the reasons that we just said. And then think about sequencing as your life changes and you get, I guess more income and more of a stable foundation, then property certainly has a place to play. And we hope that by the end of your journey and as you reach retirement, you'll have a lovely nest egg with both.

Ren: Yeah, and I think the final thing is- if you're feeling that pressure, if you're feeling like you're falling behind, you're not. The fact that you're listening to an investing podcast means that you're on the right track and whatever you're investing in is better than not investing at all. Put your money to work, make it work as hard as you do and know that over time, as long as you are consistent, you'll be okay.

A message from Schrdoers

Get the active edge. The Schroders Active ETF range spans Global Equities, Fixed Income and Multi-Asset. Access 220 years of compounded investment expertise. |

ASX: ALPH Investing in high-quality companies and growth opportunities via a thoughtfully constructed global equities portfolio designed to deliver consistent outperformance. |

Cboe: HIGH Pursuing dependable income by investing in quality, high-yielding Australian credit opportunities, within a long-standing and diversified approach. |

ASX: CORE A diversified global equity enhanced index fund with a long-term track record, combining fundamental stock selection with quantitative tools to deliver consistent outperformance at just 25bps. |

Cboe: PAYS Focused on delivering capital preservation and stable monthly returns across multiple assets classes. |

ASX: GROW Designed to outpace inflation over the medium term, providing real returns via an actively managed, diversified global portfolio of assets. |

Schroder Investment Management Australia Limited AFSL 226473 ABN 22 000 473 274. Past performance is not a reliable indicator of future performance.