- Equity Mates

- Posts

- 📈 Albo tells teens "read a book" | Silver hits all-time high

📈 Albo tells teens "read a book" | Silver hits all-time high

Here's what you need to know today

Here’s what you need to know today

Scroll down this email to find your unique referral link

Australia - 🇦🇺 🐨 🦘

Albo tells teenagers to “read a book”. As the under-16 social media ban came into effect, Prime Minister Anthony Albanese encouraged teens to try a new sport, read a book, and enjoy family time over the holidays in a video played in all schools across Australia. (ABC)

Top law firm to separate Australian, Chinese firms. 14 years after first merging, King & Wood Mallesons will split its Chinese and Australian operations. The split is blamed on strategic misalignment and different work cultures; Mallesons will remain as the Australian entity. (AFR)

Labor targets SMSFs with special levy. The Albanese government is reportedly considering a special levy on self-managed superannuation funds to pay for a compensation fund for victims of financial misconduct. The levy would target the 1.2 million Australians with SMSFs, collectively worth over $1 trillion. (AFR)

High flight demand drives up airfares. October 2025 saw 5.5 million domestic passengers carried by Australian domestic airlines, the second highest since the ACCC started keeping records in January 2019. As a result, airfares hit their highest level since December 2022. (ACCC)

Global - 🌎 🗽 ⛩️

Silver sets record, gold follows. A supply shortage and strong industrial and investor demand have driven the price of silver over $60, a new record high. Gold was also up to $4,216, close to the record set in October. Silver is up almost 100% this year, while gold is up 55%. (FT)

China limits Chinese companies buying Nvidia chips. Despite US President Trump allowing Nvidia to sell H200 chips in China, Chinese authorities announced Chinese companies must prioritise Chinese-made chips ahead of Nvidia’s. (Yahoo)

Trump announces more tariffs. Trump suggested he would impose new tariffs on agricultural products including Canadian fertiliser and Indian rice. Separately, he threatened a 5% tariff on Mexico over a water dispute. (TTN | Guardian)

US-Indonesia trade deal falters. The world’s fourth most-populous country, Indonesia, has drawn the ire of US trade officials, who claim Indonesia is not holding up their recent trade deal to reduce tariffs and trade barriers. Indonesian business groups are against the deal, saying it deprioritises domestic goods. (FT)

Companies - 🚀 🏦 🏗️

Sydney anti-AI startup hits $300 million valuation. Sydney-based Kasada raised money to build out its product which prevents AI bots from scraping websites and helps companies protect their data from AI. (AFR)

Politics, nepotism invade Netflix-Paramount battle. President Trump has declared he will be involved in the decision of who buys Warner Bros., with his son-in-law Jared Kushner financially backing Paramount’s bid against Netflix. Paramount CEO David Ellison is also the son of Oracle’s Larry Ellison, a strong Trump ally. (FT)

SpaceX eyes $1.5 trillion IPO. Elon Musk’s SpaceX is targeting the largest IPO in history, with Bloomberg reporting plans to raise $30 billion at a $1.5 trillion valuation in 2026. (Capital Brief)

Pfizer follows Eli Lilly into Chinese weight loss market. Pfizer has struck a $2.1 billion obesity drug deal with China’s Fosun Pharma. This comes one day after Eli Lilly announced a similar deal to sell its weight-loss drug in China. (SCMP)

PepsiCo cuts prices and products. Activist investor Elliott Management has pushed PepsiCo to cut nearly 20% of its products, as well as cut prices, to fight stagnating growth and profits. (Yahoo)

Google keeps racking up AI wins. Google’s TPU chips have boosted Gemini AI over OpenAI’s GPT-5 in tests. At the same time, the US Department of Defence selected Gemini as the preferred AI for its roughly 3 million military and civilian personnel. (Yahoo)

What the…? - 🧐 👀 🙉

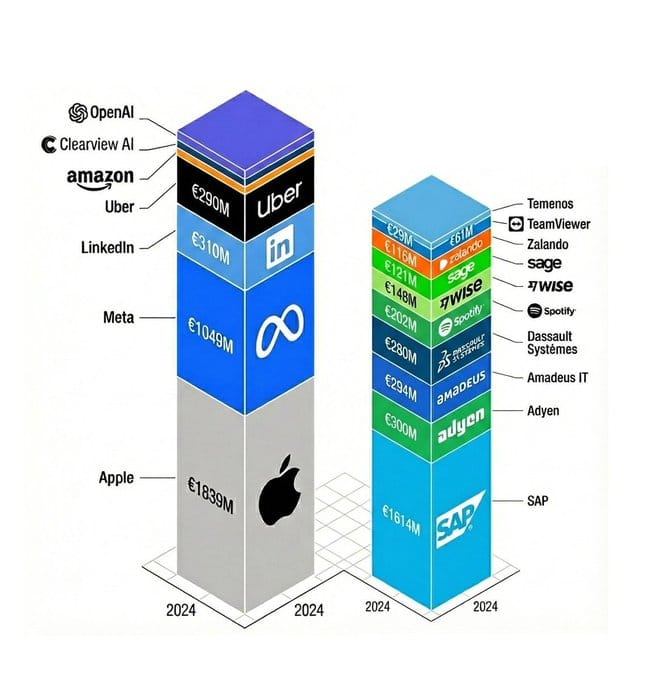

The European Union makes more money from fining major US tech companies than from the combined taxes from all major European tech companies.

Headlining the big fines are Meta and Apple, who have paid EU fines worth €1.0 billion and €1.8 billion, respectively. LinkedIn, Uber, and Amazon some of the other US tech companies that have also been fined. Just today, the EU has launched an antitrust investigation on Google for its AI-generated summaries.

US tech leaders claim that the EU is more focused on raising revenue from US tech firms than actually regulating the industry. The EU has defended the fines, claiming that the European Parliament are the only ones fighting back against US Big Tech and its violations of privacy and security laws. (Cryptopolitan | BBC | David Fant)

Investing is a lifelong journey

Here’s what you can learn today

Why Core and Satellite works

This is an excerpt from a Get Started Investing episode ‘How we’d Invest $5,000 today (December 2025)’ catch the full episode here: (Spotify | Apple | YouTube)

Ren: Core and satellite is a philosophy that we're strong believers in. And what it says is that the core of your portfolio, the majority of your money should be in investments that just buy a little bit of everything and take the overall market return. The philosophy behind it is that you invest in the whole market and then you benefit as that whole collection of companies get more efficient, get more profitable, and grow over time.

In Australia over the past 15 years, just 15% of active managers have consistently beaten the overall market. But also that the market itself has been enough over the past 124 years of the Australian stock market with dividends reinvested, it's averaged 13% a year. That is enough to build the wealth that you need to give yourself financial flexibility and choice in the future.

So that is why we say start with the core, take the stress out of it, buy a little bit of everything, and then have a satellite position where you can invest in things that interest you or invest in things that you think might beat the market. But you know that the solid core of your portfolio is just the overall market.

A message from First Sentier Investors

Offering access to a dynamic segment of the Australian market, companies outside of the ASX 20. The First Sentier ex-20 Australian Share Fund Active ETF provides a differentiated approach that sidesteps the dominance of heavyweight financials and resources, offering a more active and differentiated approach to Australian equity exposure.

Fund issued by Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL 235150). General advice only. Does not take account your objectives, financial situation or needs. Read PDS & TMD on FSI's website. All investments contain risk and may lose value.