- Equity Mates

- Posts

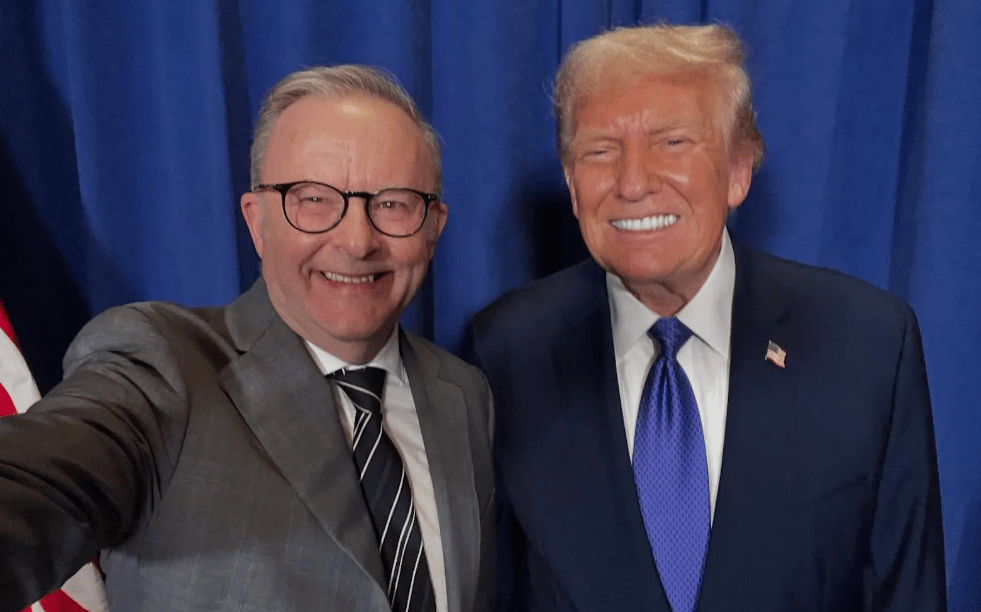

- 📈 Albanese heads to Washington | Gold’s biggest week since the GFC

📈 Albanese heads to Washington | Gold’s biggest week since the GFC

Here's what you need to know today

Want to join the Equity Mates team? We’re hiring for a couple of roles across Operations and Sales. Check out our open jobs on our website.

Anthony Albanese and Donald Trump will meet on Monday at the White House

Here’s what you need to know today

US Treasury Secretary Scott Bessent is scheduled to meet Chinese Vice Premier He Lifeng in Malaysia this week in an effort to ease mounting trade tensions. The talks come after President Trump described existing tariffs as “unsustainable,” raising hopes of a partial reset in US–China relations. (Reuters)

Also this week, Prime Minister Anthony Albanese is expected to announce a major critical minerals agreement with the US during his meeting with President Trump on Monday (Tuesday AEDT). The deal could strengthen supply chains for materials used in smartphones, turbines, and weapons, reducing US dependence on China. (AFR)

A landmark deal to cut global shipping emissions has collapsed after opposition from the US and Saudi Arabia. More than 100 countries had gathered in London to finalise the plan, which would have made shipping the first industry with binding global emissions targets. (BBC)

Global equity markets fell on Friday after two US regional banks revealed exposure to millions in bad and fraudulent loans, raising fears of broader financial stress. Director of the National Economic Council, Kevin Hassett, downplayed the concerns, saying the banking sector has “ample reserves.” Jittery investors turned to safe haven assets, with gold hitting a new record of $4,378 an ounce, a weekly gain of almost 8.5%, its biggest since the 2008 financial crisis. (Guardian)

French luxury giant Kering, owner of Gucci, is reportedly close to selling its beauty division to L’Oréal in a deal worth around $4bn. The sale would include luxury fragrance house Creed and beauty rights for brands like Balenciaga and Alexander McQueen. (WSJ)

Apple has secured exclusive rights to broadcast Formula 1 in the United States for the next five years, in a deal reportedly worth about $750m. The blockbuster success of Apple’s Brad Pitt–led F1 movie, which has grossed more than $630m worldwide, was said to be a key factor in clinching the agreement. (BBC)

One of OpenAI’s top executives, Chris Lehane, has arrived in Australia seeking data centre partnerships as the company prepares to spend up to $500bn on global infrastructure. (AFR)

Taiwan Semiconductor Manufacturing Company, Asia's largest technology company, saw profits increase by more than 39% in the third quarter, beating analyst expectations and reaffirming that demand for AI chips is showing no signs of slowing. (FT)

Meanwhile Wall Street’s biggest banks can’t agree on whether AI’s trillion-dollar boom is justified. Goldman Sachs and UBS say strong fundamentals support current valuations, while Citi and Morgan Stanley argue the math doesn’t add up, warning that hype is running ahead of profits. (Quartz)

Shares in three funds run by Blackbird, the country’s biggest venture capital firm, have changed hands at big discounts, alarming backers who fear that many of the investments have been significantly overvalued. (AFR)

What the…?

Top traders at hedge fund giants like Citadel and Millennium are now taking home nearly a quarter of the profits they make, according to a new Goldman Sachs report.

A war for talent between multi-manager hedge funds has pushed up pay in the industry, with firms luring traders with packages that can be worth more than $100m. (FT)

Investing is a lifelong journey

Here’s what you can learn today

Funding kids education

Community Question: Setting up education funding for my kids – how does this work? What are my options?

We put this question to Dylan Pargiter-Green, financial adviser and director at Bold Wealth.

Very simply, the way we do this at Bold is effectively forced savings for a known future expense. You know approximately how much schooling is going to cost and we recommend you get to that stage with enough money to pay the bill when it comes around at the beginning of the year each year.

Private schooling in Australia is a huge expense for those families who choose this pathway. Because of this, we like to plan early where possible – because compound interest is your best friend to having more savings later.

More commonly though, we use Investment (education) bonds to help fund these education fees. The reason we love these strategies is because of the favourable tax rates on growth and income throughout the investment journey (maxed at 30% tax) and the 10-year CGT free withdrawal.

We’ll often set up our client’s education funding plan to cover the high school years and potentially university, with the goal of receiving back all of the money they invested throughout the journey. From year 10 onwards, we withdraw the $ value of the school fees throughout the year, CGT free and this directly funds the education cost for the year, without needing to use savings and/or potentially take out new debt for a $40,000 bill every Jan/Feb (per child!)

This means we’re confident in meeting the school fees but also the clients have a capital pool at the end to continue to invest, pay off debt, gift to children and many other options.

Want to speak to Dylan or another of our hand-picked financial advisers? Fill out the form on our website and we’ll put you in touch.

A message from Australian Property Scout

Final Remaining Tickets to Australian Property Scout Summit

Tickets are almost sold out for the Australian Property Scout Summit on Saturday, November 15th at The Star in Brisbane. T

his is more than just a property event: it’s a full-day immersion into the strategies, systems, and mindset behind some of Australia’s most successful investors. You’ll walk away with a refined, actionable game plan for 2026, powerful clarity on your next moves, and the confidence to take your portfolio to the next level.

Final tickets remaining - secure yours now and get ready for a massive 2026! 🔥