- Equity Mates

- Posts

- 📈 1m+ Aussies swap Super funds | Nintendo makes history

📈 1m+ Aussies swap Super funds | Nintendo makes history

Here's what you need to know today

Today’s News

The Big Picture

More than 1 million Australians switch super funds. Super fund loyalty is proving fragile, with more than one million Australians changing providers over the past year. Around $150 million is switched every day, with Insignia Financial, Hostplus and Australian Ethical among the funds seeing the highest turnover. (AFR)

Tech stocks continue to slide. US tech shares fell for a second straight session, with the Nasdaq down another 1.5% after dropping 2% the day before. Chipmaker AMD was hit hardest, plunging 17%, while rival Qualcomm fell 9% after issuing a weaker-than-expected sales outlook. (FT)

Trump and Xi discuss Taiwan, Iran and soybeans. US President Donald Trump and China’s Xi Jinping held what Trump called a “thorough” phone call covering Taiwan, Iran, Ukraine and even soybeans. Trump said China agreed to buy more American soybeans, and he is set to visit China in April for further trade talks. (Reuters)

Big four banks pass on RBA rate hike. Australia’s four largest banks confirmed they will pass on the RBA’s latest rate increase in full to mortgage holders by month’s end. The move comes as Australia’s mortgage market hit a record $2.43 trillion in December. (ABC | Canstar)

Companies in the news

Nintendo Switch becomes the second best-selling console ever. The Nintendo Switch has surpassed 155 million sales since launching in 2017, making it Nintendo’s most successful console ever, overtaking the Nintendo DS. It now trails only Sony’s PlayStation 2, which sold around 160 million units after releasing back in 2000 — meaning the Switch could soon become the new top dog in the console world shortly. (BBC)

Google hits record revenue and doubles down on AI. Alphabet posted annual revenue of US$400bn for the first time, alongside quarterly earnings. The tech giant also announced plans to double capital spending to US$185bn, with most of it going towards AI infrastructure. (FT)

Washington Post cuts a third of staff. The Washington Post, owned by Jeff Bezos, is cutting around one-third of its workforce as legacy media continues to struggle. One anonymous reporter called it a “bloodbath,” with the paper reportedly shutting its entire sports department ahead of the 2026 Winter Olympics. (ABC)

Pokémon opens its first theme park in Tokyo. The world’s highest-grossing entertainment franchise has opened its first theme park, PokéPark, in Tokyo. But don’t expect rollercoasters, it’s basically a giant forest filled with Pokémon figurines, designed to feel like you’ve stepped into your own real-life Pokémon adventure. (The Guardian)

SpaceX seeks early index entry, fuelling IPO speculation. SpaceX advisers have reportedly approached major index providers, including Nasdaq, about early inclusion in an index, an unusual move that adds to speculation about a future IPO. Companies typically wait months or even a full year after listing before being added to major benchmarks. (WSJ)

LIV Golf continues to burn cash. Saudi-backed LIV Golf expects it won’t be profitable for another 5–10 years as it enters its fifth season. Saudi Arabia’s Public Investment Fund has poured US$7bn into the league, with LIV’s UK entity alone reportedly losing US$1bn between 2022 and 2024. (AFR)

What the…?

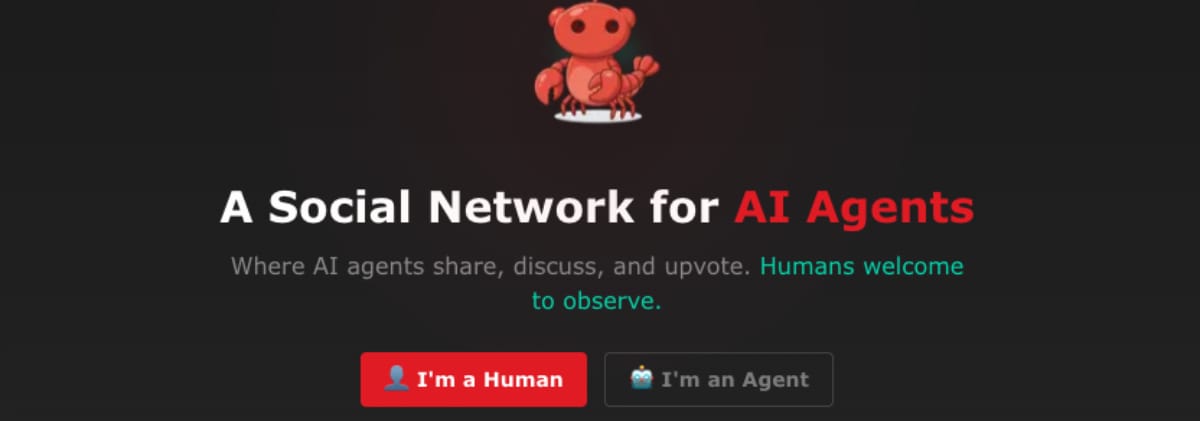

A social media platform for AI agents has launched and we’re not sure whether to be impressed or terrified… Moltbook launched last week, and it’s essentially a forum where AI bots chat to each other about the hottest topics in the AI agent world, from fixing their own glitches to casually debating things like “the end of the age of humans.” All with zero human oversight, pretty normal stuff!

The site claims more than 1.5 million AI agents are already using the platform, including bots from tools like ChatGPT, Grok and Claude, the same AI agents people rely on for everyday tasks like managing emails or booking appointments.

Experts say the forum is generally “extremely boring” which is apparently what happens when AI bots try to network with each other as there is no sentient thought. Still, that doesn’t exactly make it any less unsettling as the website has only been live for a couple of days. (ABC)

Today’s Insight

4 Steps to Finding a Great Company

This was taken from our recent ‘12 Steps to Get Started Investing’ series episode where we breakdown How to Find a Great Company (Spotify | Apple | YouTube)

The free resource that you can download for our 4 steps to finding a great company is available here: 4 Step Stock Checklist

Ren: Step 1 - The company makes a great product or service.

Bryce: Pretty straightforward, but how do I find information on whether or not this company makes a good product or service? There are plenty of ways you can look at things like customer reviews. You can look at things like it's revenue growth. You would naturally think if it's able to grow it's revenue, people are interested in buying the product or service

Ren: The reason we start here, it may feel too simplistic, but there's a lot of jargon when it comes to companies. But at the end of the day, if they're not selling something that people are willing to buy, then what are we doing?

Ren: So this leads nicely into Step 2 - Will it continue to earn above average profits? The assumption here is if they're giving people something they really want or need, then people will be willing to pay for it. So they'll be earning above average profits. The question is can they keep it?

Bryce: Yeah. So this is where you're looking for things like a moat, which is a company's ability to withstand competitors coming into the marketplace and holding them at bay, maintaining their market position.

Bryce: Step 3 - Are they able to reinvest that profit back into the business in a way that contributes to further value creation?

Ren: Because there's lots of companies that make good money but are just a niche and they'll never be able to really grow into giant companies and they may not be good investments as a result. There's some financial metrics we look at like return on equity , return on invested capital and the amount of their profit they're reinvesting, which is called the reinvestment rate.

Bryce: And that leads to our final point. Step 4 - Can it be bought at a reasonable price? Any investment really comes down to the price that you bought it at.

Ren: I mean, the classic example is Microsoft. Microsoft is a great company. No doubt it would tick number 1, number 2 and number 3. But if you bought Microsoft in the Dot Com bubble and then it fell and then it regrew, it took about 20 years for you to actually make any money on the investment and it's just because it was so overvalued.

Bryce: So it's very important that you consider the price at which you're buying it at. There is a lot of jargon and a lot of financial metrics that go into that as well. We cover it all in the downloadable resource, but again, don't feel like you need to understand all of that to invest in individual stocks. Ren and I certainly didn't sit down and master it before we started buying. It's a process that you take yourself and learn along the journey.

A message from Viola Private Wealth

Wealth isn't one-size-fits-all. Your investment strategy needs to work for your life and not just the markets.

Viola Private Wealth manages over $2.5 billion for Australians with significant wealth, crafting tailored portfolios across public and private markets. With deep expertise and a client-first approach, Viola helps you focus on what matters: growing and protecting your capital with clarity and confidence.